Table of Content

Choosing a home in a designated rural area is only the first step to qualifying for a USDA loan. That home will also need to be your primary residence — not an investment or income-earning property. If the area has 20,001 to 35,000 residents, it must have once been considered rural but lost its status in the 1990, 2000, or 2010 Census.

If you’re someone who makes at or below the average salary of your area, then you could potentially qualify for a USDA loan to help you buy a house in a rural part of the United States. Under the USDA loan program, buyers don’t have to pay a down payment. For primary residences, the loan package entails a 30-year fixed-rate plan. USDA eligible homes open the door to countless benefits. For one, USDA loans require no down payment, which can make purchasing a home significantly more affordable upfront. Department of Agriculture - Rural Development (USDA-RD) and U.S.

USDA Eligibility Map: Verify an Address

Viewing eligibility maps on this website does not constitute a final determination by Rural Development. To proceed with viewing the eligibility map, you must accept this disclaimer. USDA provides homeownership opportunities to low- and moderate-income rural Americans through several loan, grant, and loan guarantee programs. The programs also make funding available to individuals to finance vital improvements necessary to make their homes decent, safe, and sanitary.

If the property shows up in a shaded area of the USDA eligibility map, it is not currently eligible. FSA loans can be used to purchase land, livestock, equipment, feed, seed, and supplies. Loans can also be used to construct buildings or make farm improvements. USDA, through the Farm Service Agency, provides direct and guaranteed loans to beginning farmers and ranchers who are unable to obtain financing from commercial credit sources. Each fiscal year, the Agency targets a portion of its direct and guaranteed farm ownership and operating loan funds to beginning farmers and ranchers.

Housing Assistance

In addition, rental assistance is available to eligible families. Leveraging a USDA property eligibility map is only the first step if you want to use these valuable loans in your homebuying journey. You can use this USDA eligibility map to find USDA-eligible homes in your area. Look up the address you’re interested in purchasing to verify it falls within a rural area, as determined by the U.S. AMS administers two organic certification cost share programs.

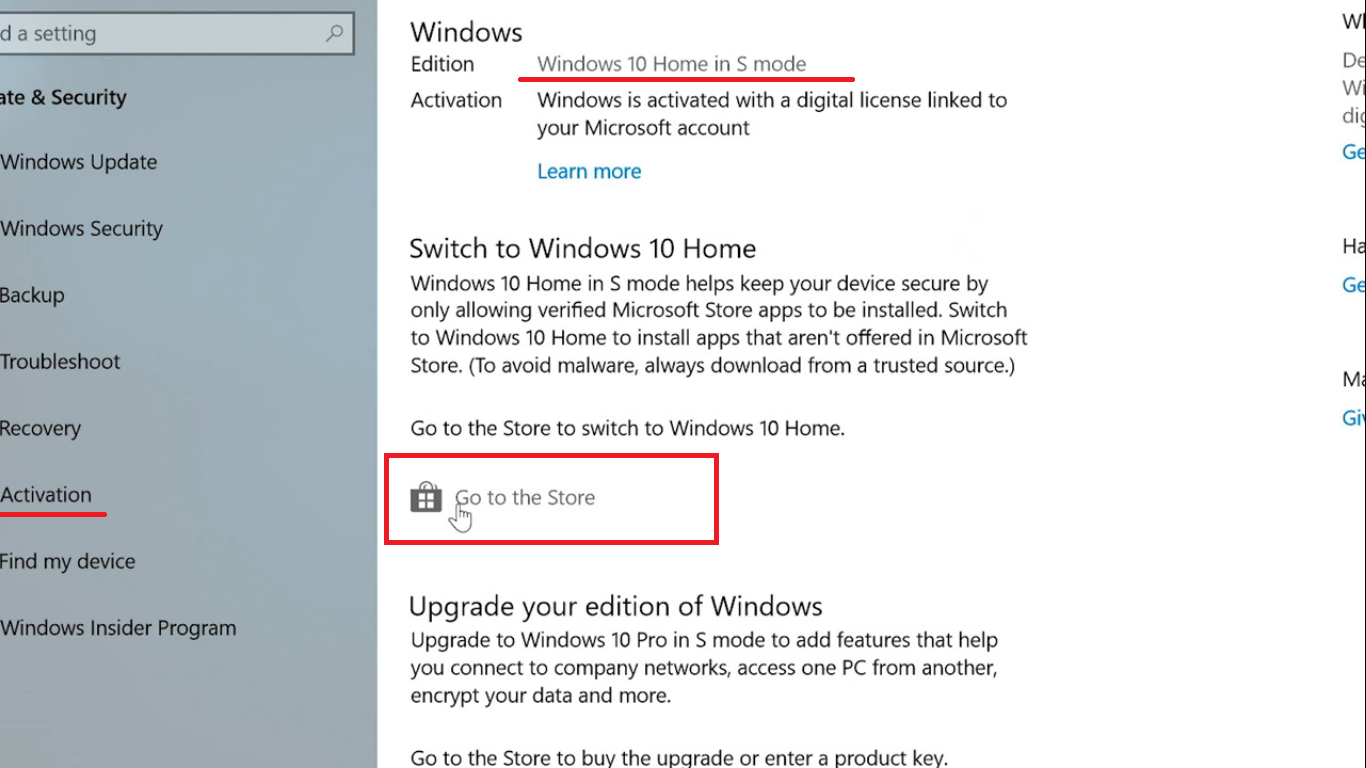

Department of Agriculture - Farm Service Agency have properties listed on this site. For additional information regarding the purchase requirements to buy these properties, please reference the How to Buy link. Getting a USDA mortgage loan can be a tricky road to go down if you do it yourself, and that’s what we’re here for!

The Farmers Market Promotion Program

A .gov website belongs to an official government organization in the United States. Moreover, the state won’t consider any income from anyone who doesn’t live in the house officially, such as a live-in nurse. That said, the USDA will make exceptions for large families (i.e. five or more).

These previously owned properties are for sale by public auction or other method depending on the property. If you’re still on the fence a USDA property eligibility, then the best thing you can do is contact us. Here at Trinity Mortgage, we want to make sure you’re getting the right loan for you, and we’d love to help you through that process.

Other Property Eligibility Requirements

Looking for a home that will qualify for a USDA Home Loan? Use RanLife USDA Rural Property Search tool to see if your home would qualify for 100% financing . After you’ve applied for your loan, your USDA lender will send out an appraiser to assess the home’s value and condition and ensure the home meets all the above standards.

Additionally, cosmopolitan areas usually cannot accommodate farmland. This article will help you determine if your area qualifies for a USDA loan.

There are interactive maps you can use that are directly from the USDA department in your state, and a quick Google search can help you find the one for your state. The physical location of the property plays a big role in the eligibility of a USDA loan. Please fill out the above USDA Property Search completely. For additional information and to contact a USDA Program Representative, click on the Contact Us link above, and then select the appropriate USDA program.

RANLife is not acting on behalf of or at the direction of HUD/FHA/USDA or the Federal government. All information is kept confidential and is not shared with any 3rd party vendors. RanLife is a USDA, FHA, VA FNMA and FHLMC approved lender. Veterans and active US military may be eligible for a $0 down VA loan. Overall, all household members cannot have an income that’s more than 115% of the median income of the area.

Plus, the USDA won’t consider any income earned from a minor. In terms of property values, the home cannot be more than the value of the loan amount. These areas are the ineligible areas, whereas the unshaded areas are usually eligible. On the other hand, the USDA excludes metropolitan regions because these areas always have more than 35,000 people.